Careers

Join Our Team!

TempWorks Software is the premier provider of staffing software solutions and payroll services for temporary staffing and recruiting companies nationwide.

Founded in 1997 and headquartered in Eagan, Minnesota, TempWorks has grown from a start-up business to a corporation. Our growing team of 180 employees serve more than 500 clients.

Interested in joining our growing team? Check out our open positions below.

OUR EMPLOYEE BENEFITS

Comprehensive Medical, Vision, and Dental Plans

Health Savings Account with Company Contribution

401(k) with Company Match

Employer Life Insurance and Disability Coverage

Paid Time Off and Paid Holidays

Paid Parental Leave

Volunteer Time Off

Employee Referral

Flexible Work Arrangements

THE TEMPWORKS COMMUNITY

TempWorks cultivates a work environment that is engaging, challenging, and highly collaborative with opportunities to expand careers and create a healthy work-life balance.

Our teams are dedicated to delivering superior support services and cutting-edge software products to our clients. We encourage continual training and learning, welcome nerdiness, and embrace creativity and resourcefulness.

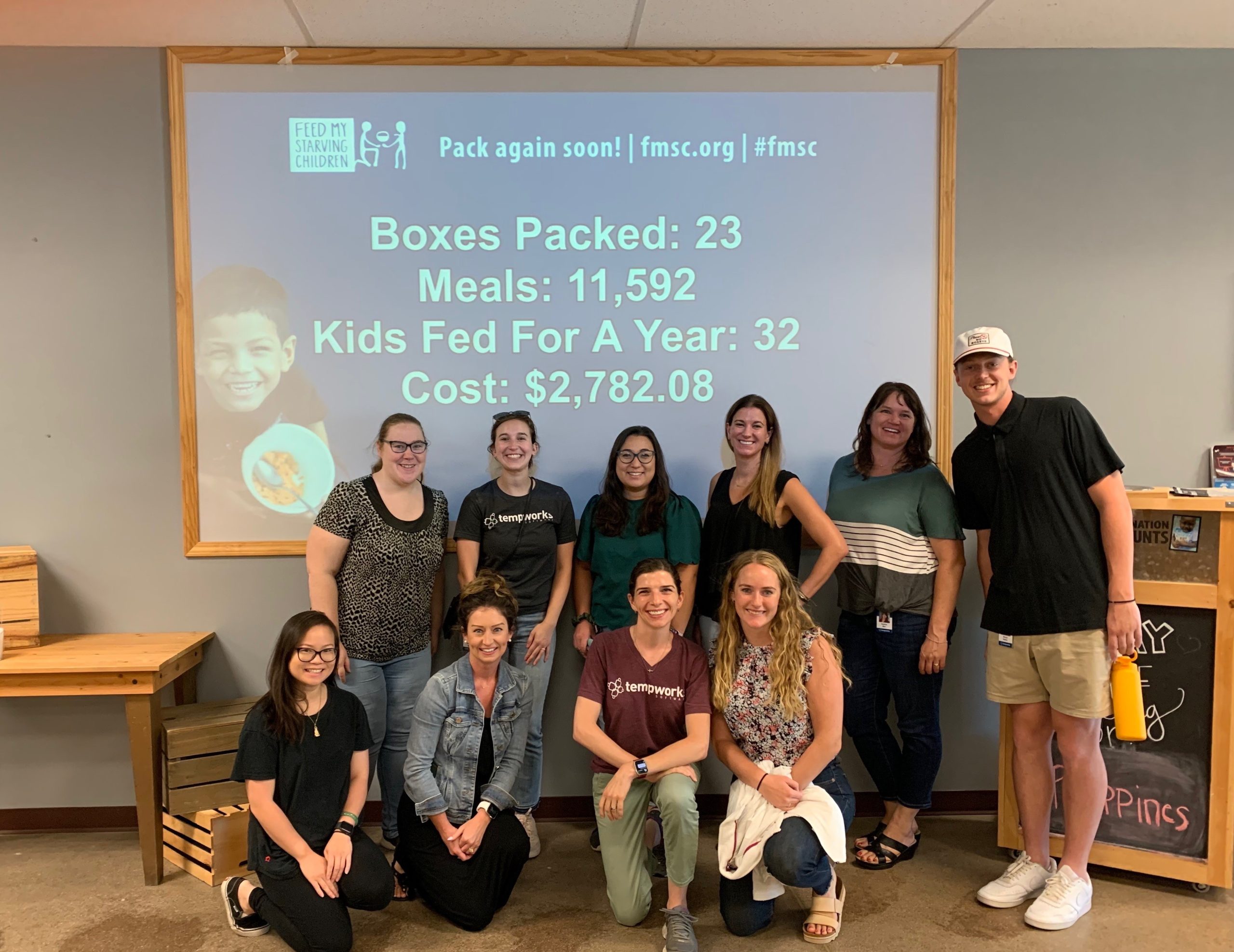

Make A Difference

We believe in making a difference outside the office walls, so we empower team members to engage with causes they are passionate about. TempWorks supports employees to utilize our Volunteer Time Off (VTO) program. Whether it’s volunteering at local nonprofits, participating in community-driven initiatives, or lending a helping hand, we value the impact our employees can make.

Teamwork & Collaboration

At TempWorks, our culture thrives on building meaningful relationships to drive success and innovation. Employees are encouraged to engage in a variety of activities designed to cultivate relationships, ignite fresh ideas, and amplify professional development. Company-wide celebrations, cross-functional lunch-and-learns, summer bbq’s, holiday bingo – these are just a few ways our teams come together to share ideas and experiences.

Investing in Talent

Our commitment to cultivating top talent and exceptional leaders goes beyond daily operations. Our annual Leadership Conference stands as a cornerstone event, uniting talents from across the company dedicated to professional growth and collaboration. We strive to build a community where your success is our collective achievement.