Are you missing out on valuable tax credits? Do you need a quick way to determine candidate WOTC eligibility?

TempWorks Software and Tax Credit Co (TCC) are partnering to bring you a webinar highlighting a WOTC solution that will help you maximize your tax incentives.

Each year, companies miss out on valuable tax credits due to incomplete employee WOTC paperwork. For your company to get these cost-saving tax credits, your employees need a quick way to input answers to common WOTC questions so you can easily determine their eligibility. That’s where TempWorks and TCC come in.

The TCC WOTC integration embeds WOTC questions directly within HRCenter, allowing employees to complete the survey faster and with fewer clicks—all without leaving TempWorks. This next-generation integration reduces abandonment, speeds up the time-to-hire, and leads to substantially higher tax credit savings.

TCC is the fastest growing tax credit provider in the country, offering a flexible and customized WOTC solution designed to meet the unique needs of staffing clients. This includes streamlined integrations, industry-specific reporting, and dedicated service resources.

The Work Opportunity Tax Credit (WOTC) is a federal tax credit program that encourages businesses to hire individuals belonging to certain target groups (e.g., Veterans or Public Assistance Recipients).

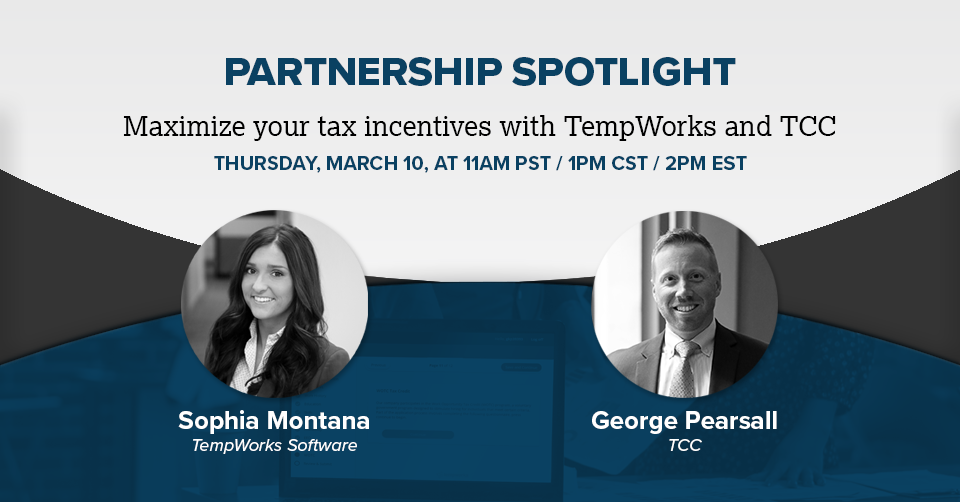

Join Sophia Montana (TempWorks) and George Pearsall (TCC) on Thursday, March 10, at 1PM CST / 2PM EST for a product demo to learn more about TCC’s WOTC solution.

Integration Highlights:

- Embedded in HRCenter. Candidates are not redirected to a third-party website.

- Faster process. The TCC survey is up to 3x faster per candidate.

- Payroll automation. Weekly payroll files are automatically sent to TCC.

Register today to save your spot!